VelasCommerce.com

VelasCommerce.com

Introduction:

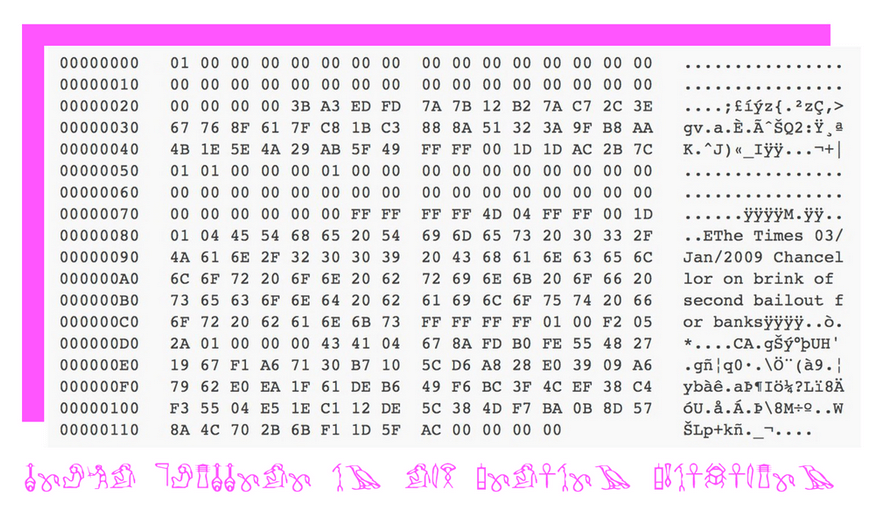

As bitcoin gains more adoption and connects more users, its natural to see disputes over what data should be mined into a block on bitcoins blockchain and at what cost. Since the early days of Bitcoin, embedding arbitrary data on the blockchain has been possible. First, Satoshi referenced a newspaper headline in the genesis block.

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

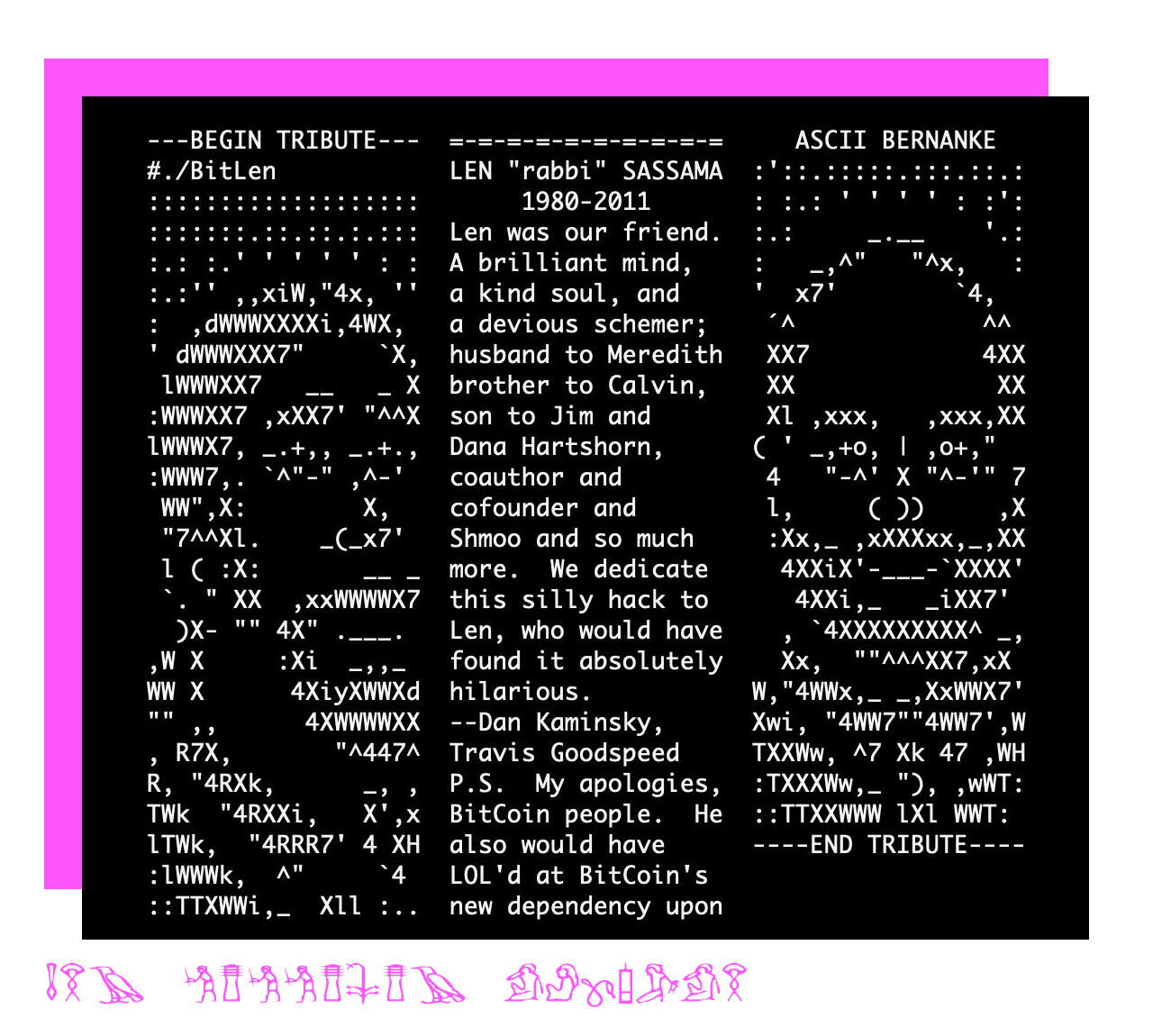

In 2011, ASCII renderings of Len Sassaman and Ben Bernanke appeared on the bitcoin blockchain, possibly the first blockchain-based art.

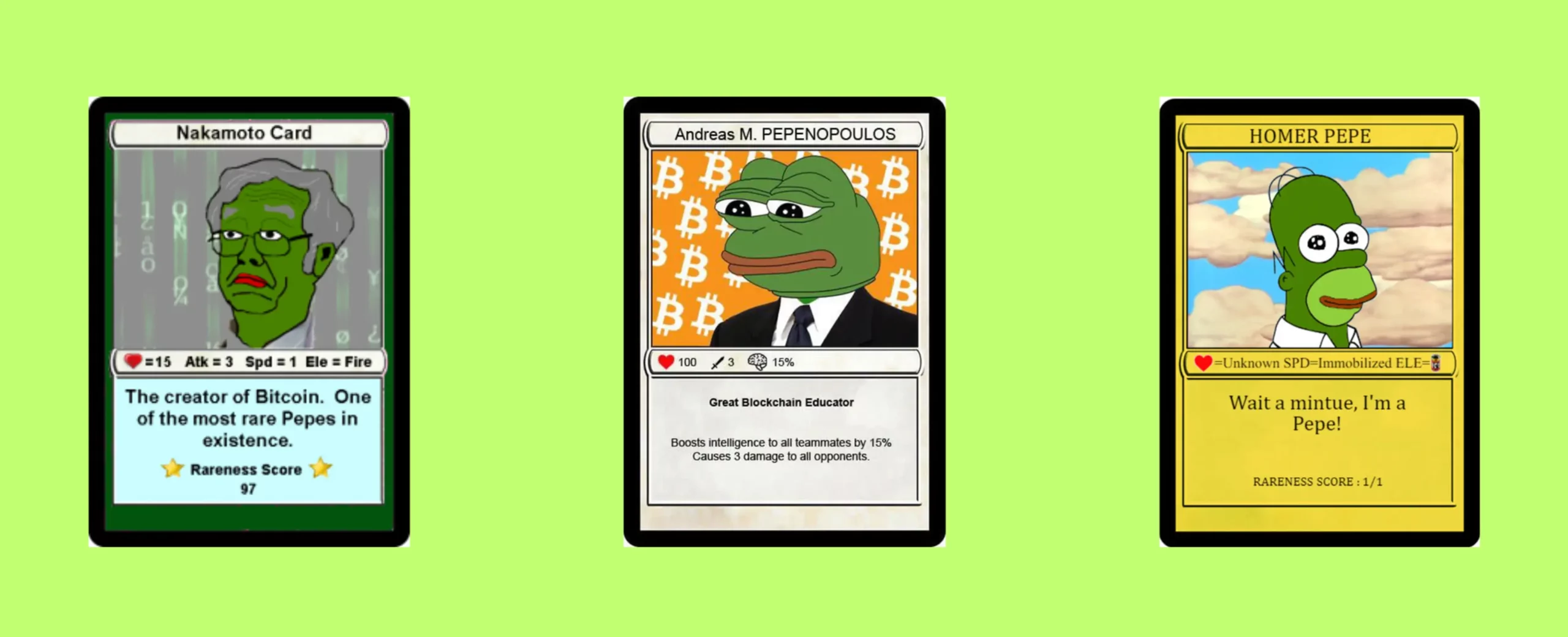

However, this data was not owned by any user. The Namecoin blockchain, which forked from Bitcoin in 2011, introduced the first ownable digital assets, considered the first NFTs, and created “Quantum,” the first visual NFT in 2014. Colored coins, allowing the differentiation of certain Bitcoins, were proposed in 2012. Counterparty, a layer 2 protocol for Bitcoin, utilized OP_MULTISIG in 2014 to create tokens, enabling projects like Spells of Genesis and Rare Pepes. In September 2016, the very first rare Pepes were mined in block 428919 on Bitcoin pre-dating popular Ethereum based NFTs.

Technical updates to Bitcoin, such as SegWit and Taproot, further supported this trend, leading to the launch of Ordinals. In this blog post, we delve into the journey of Bitcoin’s block wars, the implementation of SegWit, the introduction of Taproot, and the significant impact of Ordinals on transaction fees, scalability, and more. These developments have played a crucial role in shaping the Bitcoin ecosystem and addressing key challenges faced by the network.

The Block Wars of 2017:

The block wars were driven by concerns over Bitcoin’s scalability as its popularity surged. Congestion on the network resulted in higher fees and slower confirmation times. The disagreement centered around SegWit, a soft fork proposal to increase block capacity by separating transaction signatures from transaction data, and Bitcoin Unlimited, which aimed to increase the block size limit through a hard fork.

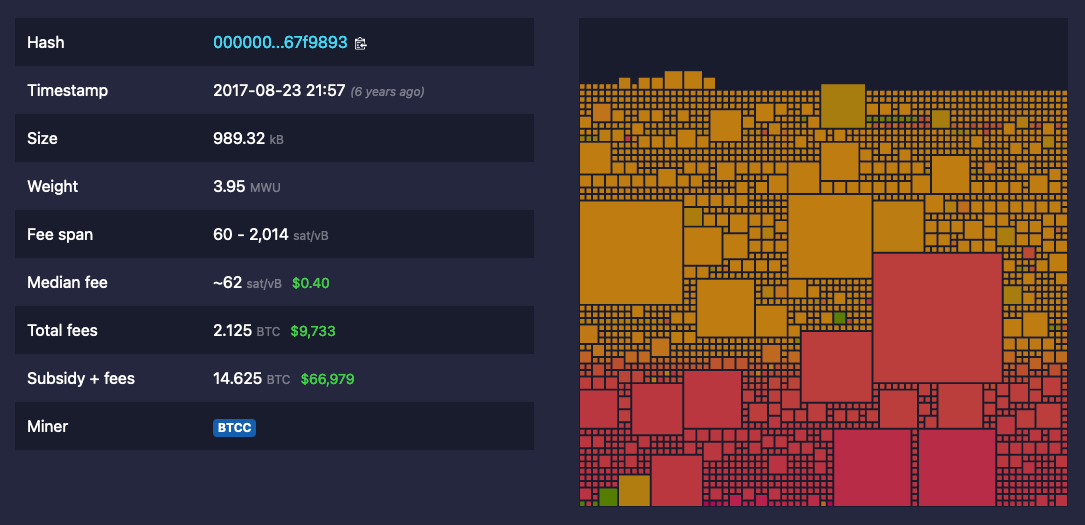

August 24th, 2017 Block #481,824 SegWit Implementation:

Mempool Visual of Block 481,824

SegWit addressed several long-standing issues within the Bitcoin protocol. First, it resolved transaction malleability by segregating signature data, ensuring it no longer affected the transaction ID.

Second, it increased block capacity by excluding signature data from the block size calculation, reducing congestion and fees. Additionally, SegWit introduced script versioning for future enhancements without requiring a hard fork (new blockchain).

Its backward compatibility made adoption easier for users, wallets, and exchanges. Segwit also enabled smart contracts that make the Lightning Network possible.

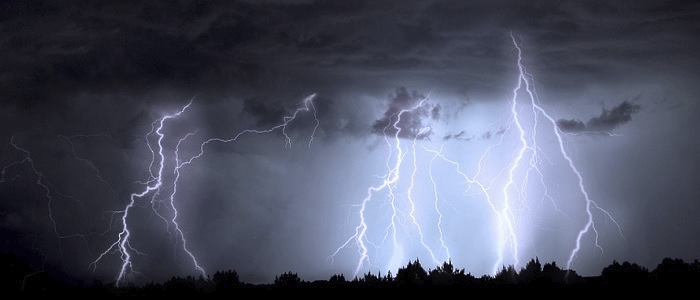

December 15, 2017 First Lightning Network Transaction:

Lyn Alden Report on the Lightning Network

The first ever Lightning Network transaction on mainnet was by software developer Alex Bosworth from Lightning Labs. The Lightning Network (LN) is a Layer 2 protocol designed to address the scalability limitations of the Bitcoin blockchain.

It enables faster, cheaper, and more efficient transactions by creating off-chain payment channels between users. These channels allow multiple transactions to occur without recording each one on the blockchain, reducing congestion and increasing scalability.

LN fosters near-instantaneous payments, promotes micropayments, and opens up possibilities for broader adoption of Bitcoin by improving its speed and cost-effectiveness. LN maintains decentralization and censorship resistance by allowing users to run their own nodes and create individual payment channels. LN fees typically are 0.1% of the payment amount. LN is capable of processing up to 1,000 transactions per second per node, and potentially reaching 1 million transactions per second across the network.

Routing nodes, incentivized by routing fees, play a crucial role in balancing channels and ensuring reliable payments. Think about layered money and remember that bitcoin will scale in layers.

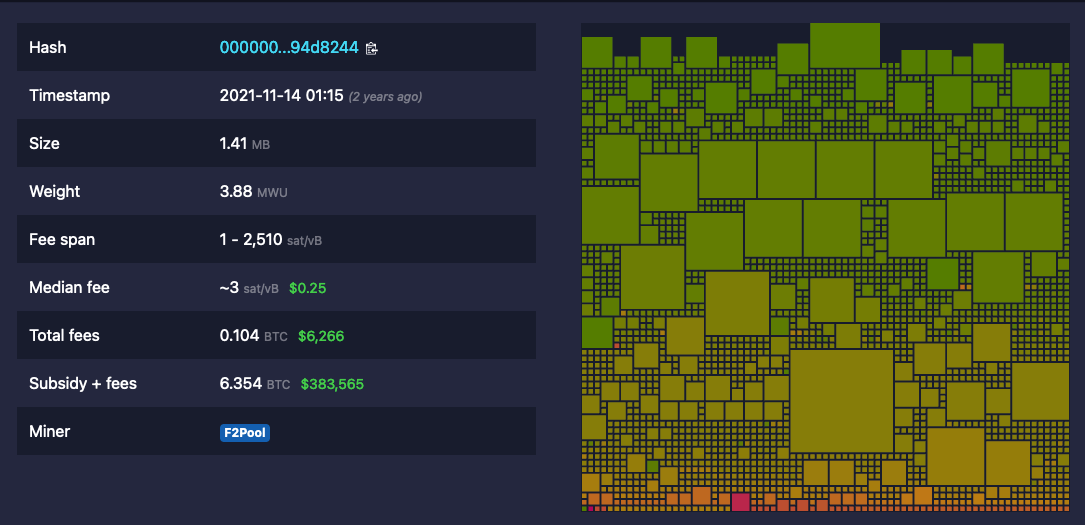

November 14th, 2021 Block #709,632 Taproot Implementation:

Mempool Visual Block 709,632

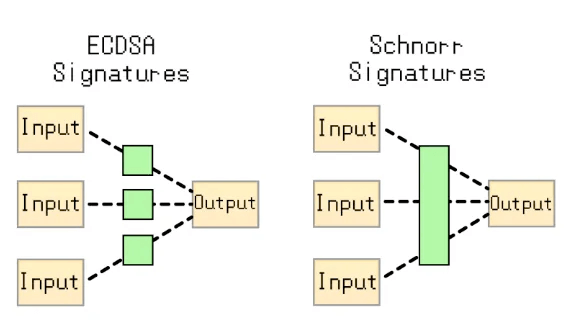

Taproot sought to enhance privacy, flexibility, and efficiency. Taproot aimed to obfuscate complex transactions and introduce Schnorr signatures for signature aggregation & reduction of transaction size.

Elliptic Curve Digital Signature Algorithm Vs. Schnorr Signatures

Elliptic Curve Digital Signature Algorithm Vs. Schnorr Signatures

Like other upgrades in the past, Taproot aimed to improve scalability, and ensure backward compatibility like SegWit. However, there were several criticisms such as; centralization of privacy due to complex smart contracts, the complexity and associated implementation risks, adoption challenges, and the potential for unintended consequences.

February 1st, 2023 – Block 774,628 Ordinals:

Segwit, Taproot, and Ordinals all have experienced the same criticisms surrounding them.

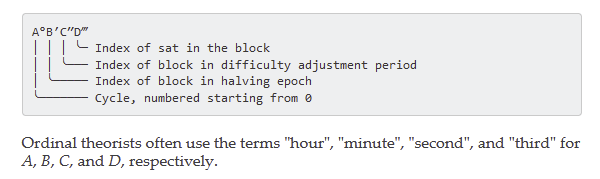

So, we need to cover the impact of Ordinals on Bitcoin. Ordinals are a numbering scheme for satoshis that allows tracking and transferring individual sats. Ordinals enables the creation and storage of non-fungible digital assets on the Bitcoin blockchain, providing a new avenue for NFT enthusiasts and strengthening Bitcoin’s position as a store of value.

Casey Rodarmor – Ordinal Theory

Casey Rodarmor – Ordinal Theory

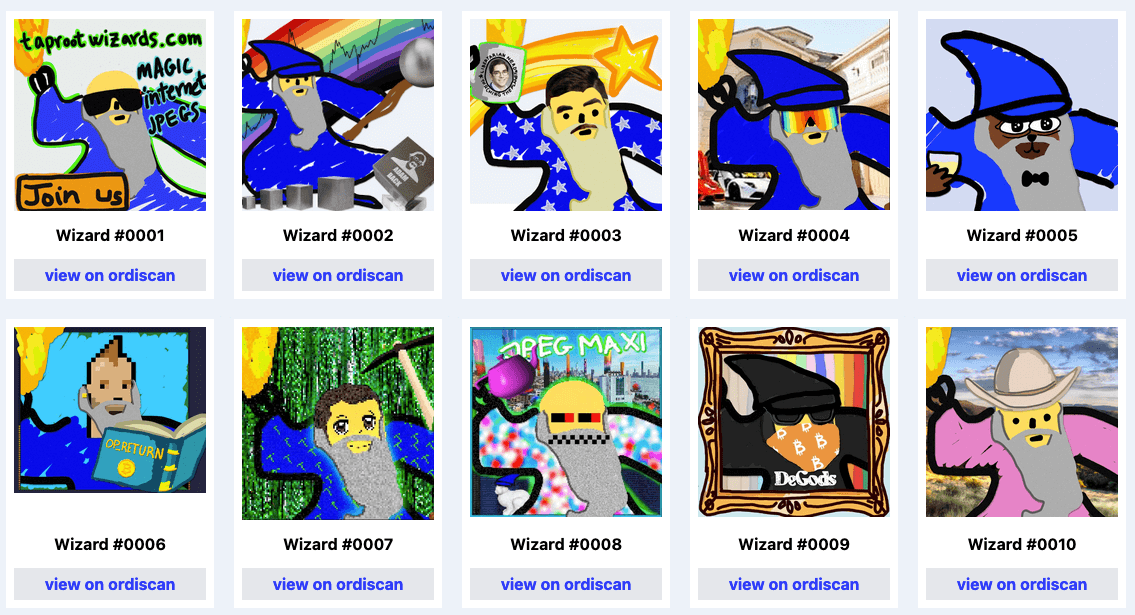

The inscription of valuable ordinals on Bitcoin should justify the higher fees, ensuring that only truly valuable NFTs are created and sold. Critics will point out that some NFT collections on Bitcoin are wasting space by bloating the blockchain with transactions of questionable value.

Taproot Wizards – One of the most valuable NFT projects on Bitcoin

Taproot Wizards – One of the most valuable NFT projects on Bitcoin

Storing ordinals consume more block space than regular transactions, driving up transaction fees.

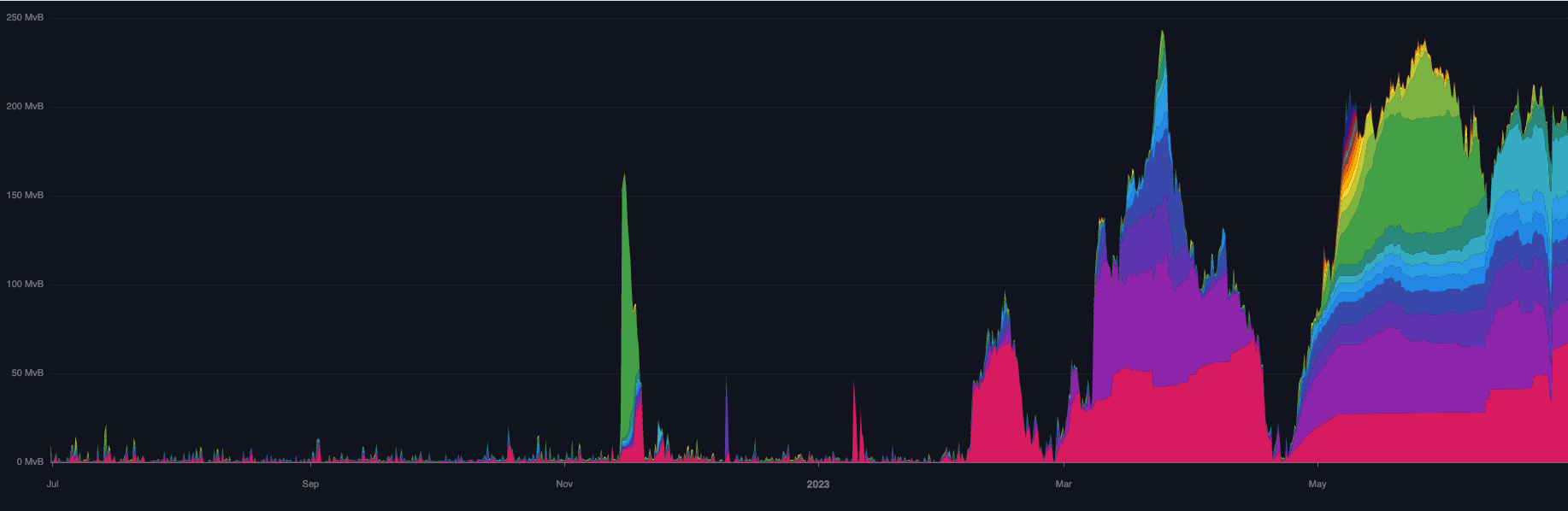

On-Chain Fees Q2 2022 to Q2 2023. Ordinals era began in Feb 2023 causing a spike in vBytes (sat/vByte)

On-Chain Fees Q2 2022 to Q2 2023. Ordinals era began in Feb 2023 causing a spike in vBytes (sat/vByte)

However, high fees on the main chain are not necessarily a bad thing. Transaction fees play a vital role in the Bitcoin ecosystem. They incentivize miners, ensure economic sustainability as block rewards decrease, prevent spam, and encourage the adoption of layer two technologies. Higher fees indicate increased demand for Bitcoin and incentivize more miners and nodes to join the network, potentially solving Bitcoin’s security budget problem.

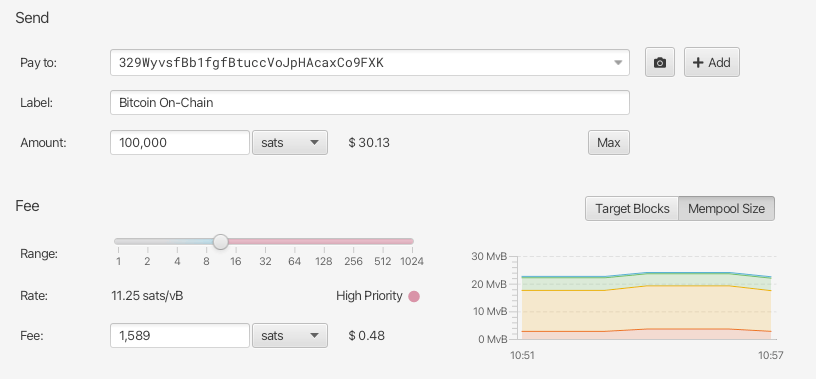

As of Block 796,581- Bitcoin On Chain Fees 11.25 sats/VB

As of Block 796,581- Bitcoin On Chain Fees 11.25 sats/VB

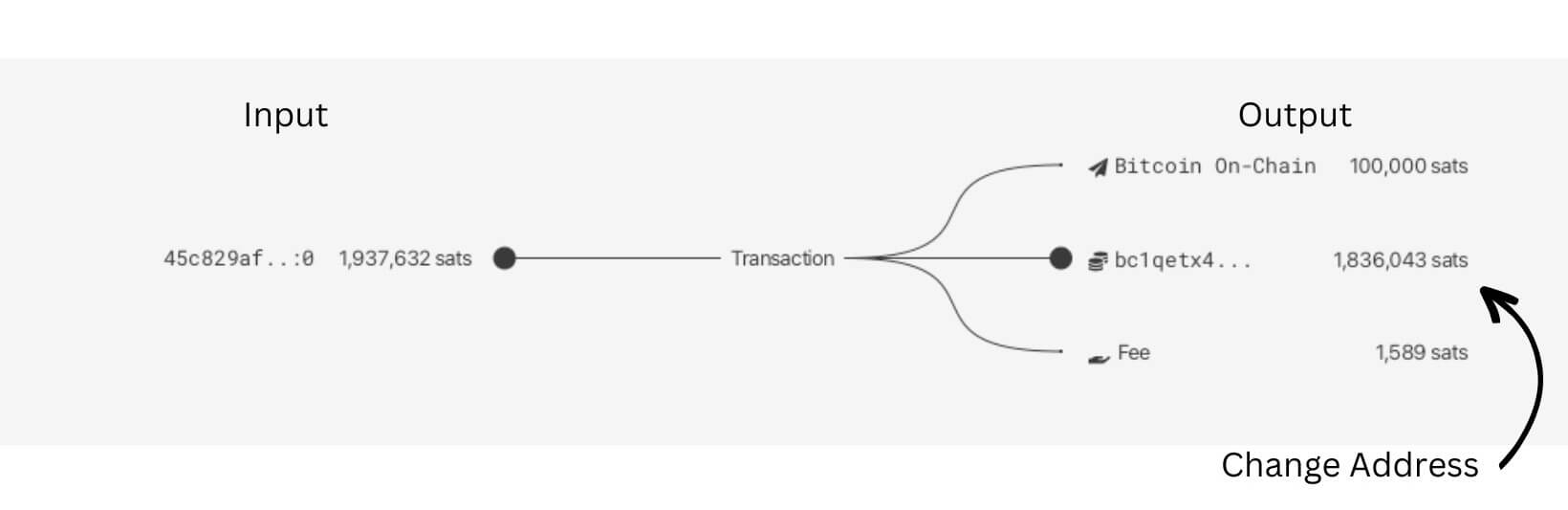

Transaction Construction on June 30th, 2023 for 100,000 sat Payment On-Chain Fee 1,589 Sats

Transaction Construction on June 30th, 2023 for 100,000 sat Payment On-Chain Fee 1,589 Sats

The “security budget” of Bitcoin refers to the overall expenditure allocated to miners or the total amount spent on mining. A lower value of this budget makes 51% attacks more affordable. Increased usage of block space by Ordinals could pave the way for solving Bitcoin’s security as the block subsidy decreases.

Conclusion:

In the history of Bitcoin, from the block wars to the great ordinal debate, we have seen significant advancements in addressing scalability, privacy, and functionality through the implementation of SegWit, Lightning Network, Taproot, and Ordinals.

These upgrades have improved transaction efficiency, increased block capacity, enhanced privacy, and facilitated the creation of non-fungible digital assets on the blockchain.

Despite criticisms surrounding complexities and higher transaction fees, these developments have strengthened Bitcoin’s position as a store of value, incentivized miners, and encouraged the adoption of layer two technologies. By addressing scalability challenges and ensuring economic sustainability, Bitcoin continues to evolve and adapt, paving the way for a more secure and versatile Bitcoin ecosystem.

References:

- https://www.lynalden.com/lightning-network/

- https://www.lynalden.com/bitcoin-security-modeling/

- https://rodarmor.com/blog/ordinal-theory/

- https://medium.com/kaleidoscope-xcp/the-early-evolution-of-art-on-the-blockchain-part-1-d52d1454e34b

- https://bitcoinmagazine.com/culture/bitcoin-ordinals-need-standards

- https://www.citadel21.com/bitcoin-hieroglyphics

- https://bitcoinmagazine.com/culture/pepe

- https://mempool.space/

- https://sparrowwallet.com/

- https://blog.cryptostars.is/do-you-know-what-is-schnorr-signatures-d3e6578cc38c

- https://www.truthcoin.info/blog/security-budget/

- https://www.truthcoin.info/blog/security-budget-ii-mm/

0 Comments