The rise of Lightning Service Providers for Bitcoin offers a practical solution for businesses and developers looking to integrate the Bitcoin Lightning Network without the heavy lift of building infrastructure from scratch. These providers simplify access to faster, cheaper, and more private transactions, making it easier to leverage the full potential of the Lightning Network.

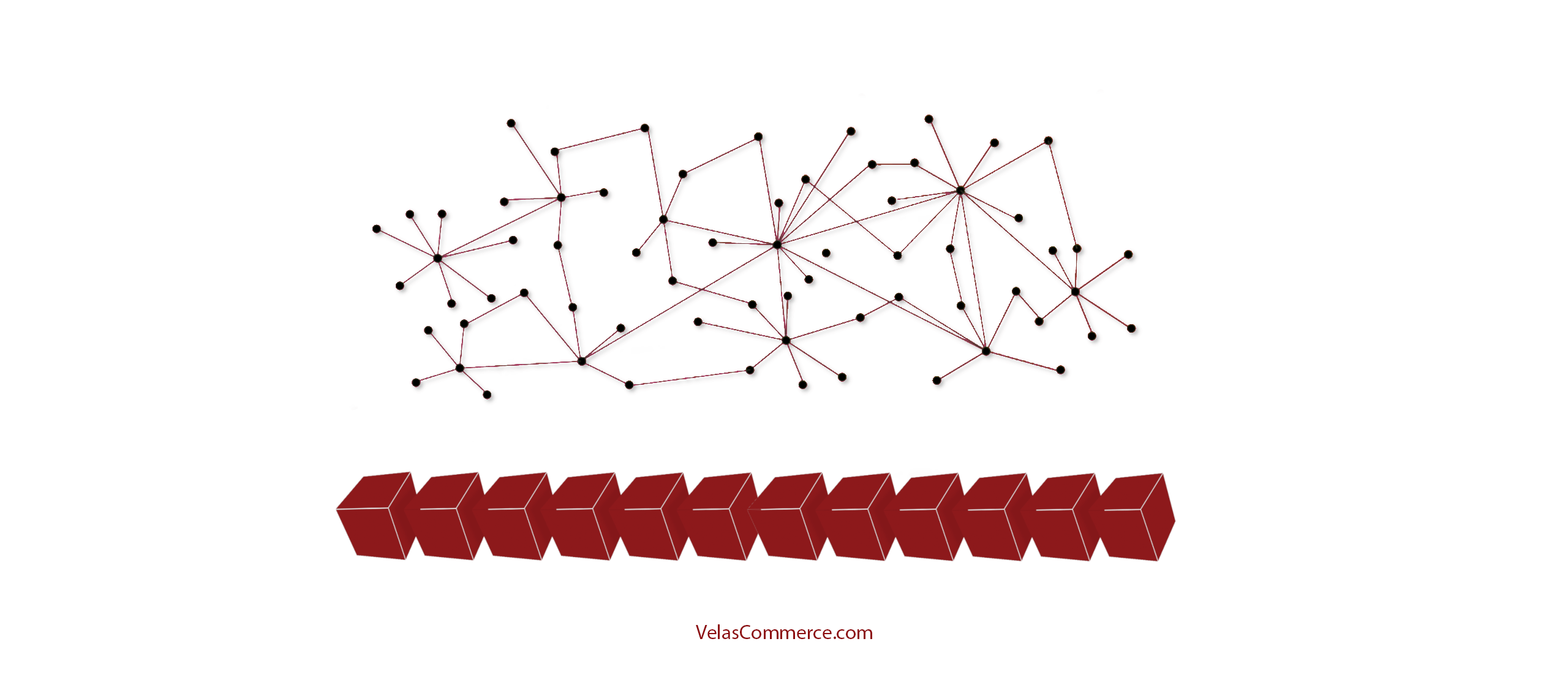

The Bitcoin Lightning Network is a layer-two scaling solution for Bitcoin designed for faster, cheaper and more private transactions using payment channels.

Integrating the Lightning Network enables a whole range of features that are completely impossible using traditional payment systems, and even impossible for the layer one Bitcoin Network.

For example, compared to on-chain transactions, Lightning makes traditional retail payments possible using bitcoin. Businesses no longer have to trust that customers will not try to cheat on payments using replace by fee transactions. Customers no longer have to wait for on-chain confirmations (a process that can take a long time!) when making purchases.

In addition to enabling traditional payments, Lightning also makes micropayments possible. And this is where we are seeing some of the coolest new tech being developed to drive user engagement.

Let’s add to this some really cool emerging features, such as Taproot Assets, NOSTR Wallet Connect, L402s and Lightning addresses and we are starting to see a real market develop for Lightning Network integrations.

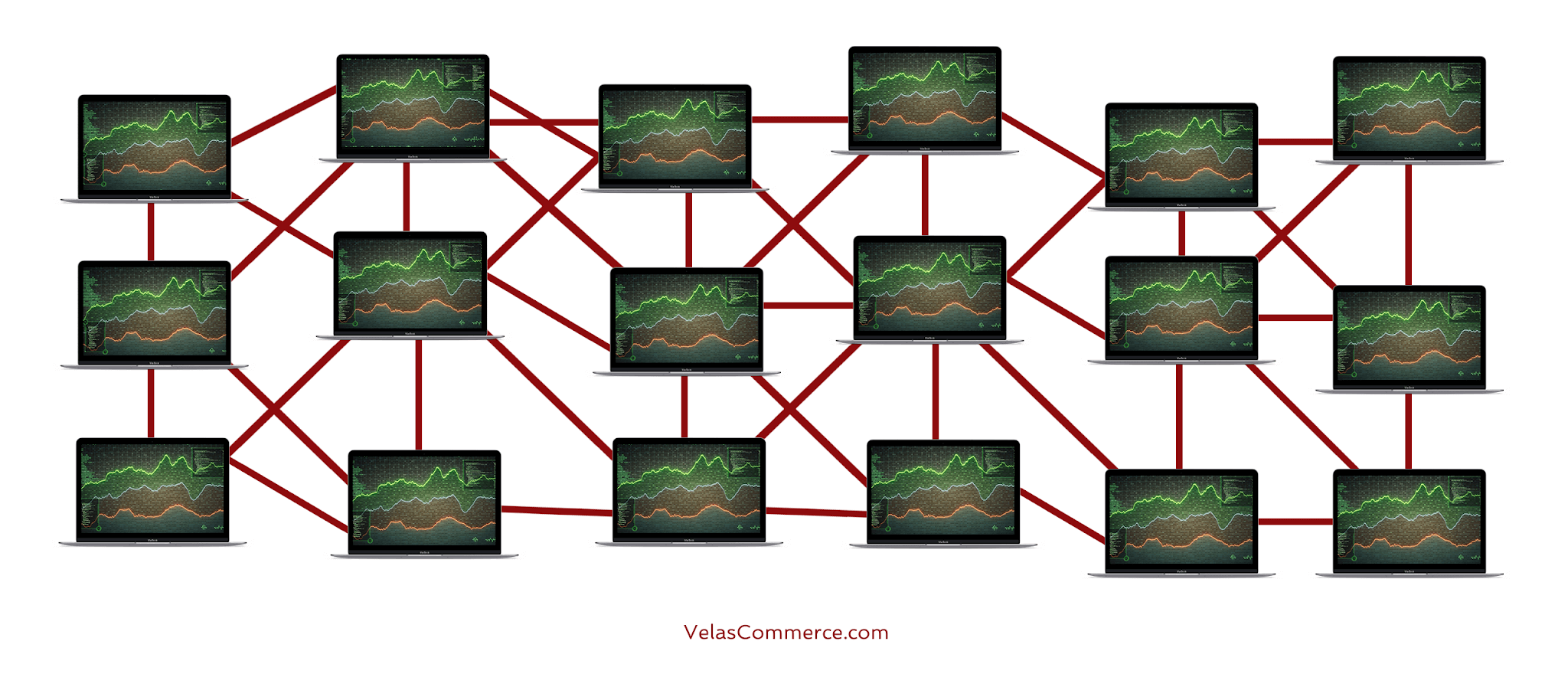

However, even with all these benefits and the strength of this emerging market, building Lightning Network infrastructure from scratch is a pretty heavy lift for many businesses technical capacity and budget.

And if you are a company that isn’t already in the bitcoin space, there is a whole element of liquidity that can put this infrastructure totally out of reach for those that don’t have loads of bitcoin sitting around to invest in Lightning nodes.

So let’s say one of these is you: You have a mobile app and you think your users would love to make peer to peer payments using bitcoin for small in-game purchases. Or you have a website and you want to engage your users by providing bitcoin rewards. Or you have a brick and mortar store and you’d love to gain some publicity and new customers by accepting bitcoin payments.

We’re going to assume that, in none of these cases, you have tons of bitcoin laying around and that you don’t want to get involved in a complex software development project starting from square one.

Enter Lightning Service Providers, which from now on, we’re going to call LSPs.

So what is a Lightning Service Provider for Bitcoin?

The Lightning Labs builders guide defines LSPs as “is an entity providing liquidity services on the Lightning Network on behalf of others. Channels in the Lightning Network are naturally constrained by their size, and capacity is further limited by local and remote balances.”

Or, to quote from Breez Technologies: “They provide users with a stable connection to the Lightning network, simplified channel management, and liquidity.”

Do you notice some nuances in the two definitions? I think one of the most important things to keep in mind when discussing LSPs is the newness of the idea and the speed at which it is developing.

I would argue that both definitions are wholeheartedly correct, however the Breez definition takes into account infrastructure as well as liquidity providers.

** A 2025 update here**

Note that this space has grown quite rapidly since the original post. We still like the broad definition of LSP. But, in order to keep our list manageable and useful as a reference we are only including liquidity providers that provide programmatic access. This is in keeping with the goal of this post, which is to provide a reference to developers and project leaders looking to develop Lightning Network applications.

Also, from a blue sky perspective, I think it’s worth noting the difference between a Lightning Service Provider and a payment processor. For example, why would one consider Breez as a Lightning Service Provider, but BitGo or BitPay as a payment processor? In my opinion, the answer is that a Lightning Service Provider is a non-custodial solution. If you are using a Lightning Service Provider, you and/or your customers hold their own private keys.

Let’s break the infrastructure and liquidity services a little bit into easier to understand terms. Integrating Lightning comes with some major hurdles. LSPs are designed to help take the pain out of this by providing ready built solutions for engineers to plug in, versus developing from scratch.

On the infrastructure side, Voltage and Greenlight are great examples. Voltage is designed to quickly deploy server-side Lightning Nodes and Greenlight is designed to quickly stand up mobile client-side nodes. From a computing point of view, these are ready-built solutions for server and client infrastructure!

On the liquidity side of the equation, being able to reliably route payments requires opening up a well-connected, carefully maintained and highly automated lightning node. There are all kinds of strategies for setting these up and keeping your liquidity balanced, but that is well outside the scope of this article.

The upshot is that managing Lightning node liquidity is specialized, involved work. If you’re looking to integrate Lightning, and making money from routing Lightning payments isn’t the core of your business model, it may make more sense to obtain this as a service by companies that specialize in it.

What options for Lightning Service Providers are available?

Both thebitcoinmanual.com and lightning-landscape have really great lists of LSPs, so make sure to check those out too.

But let’s break the different Lightning Service Providers for Bitcoin up a little into various types to help get our heads around it. In my opinion, in the current state of the art, we have:

- Liquidity Providers

- Infrastructure Providers

- Combined Liquidity and Infrastructure Providers

There is actually a growing number of LSPs that are being developed as combinations. Voltage enterprise nodes and the Breez SDK are great examples of combination LSPs, as server-side and client-side infrastructure, respectively.

A Voltage enterprise node aims to provide a highly reliable, always liquid node for your servers to utilize. Breez SDK uses Blockstream Greenlight nodes and their own liquidity solution to provide that same high-reliability, always liquid solution for client side software in mobile apps. LDK node, since the addition of C= and support for LSPs, is another recent addition to this combined infrastructure and liquidity provider list.

We’re going to break this down now by LSP type and also provide our estimates of current costs of each. Keep in mind that some of these options can come with a huge range in cost, depending on requirements. So it’s going to pay to do your homework here and nail down exactly what is needed and what isn’t.

Also note, not only is this list not exhaustive, but also that this space is growing rapidly so it will pay to check in constantly for new developments. One interesting example of this, and an update in this 2025 version of the post, is the addition of LSPs like Megalithic and Olympus that offer programmatic channel openings to user nodes.

| Service | Description | Type | Open Source | Cost Range |

| Amboss Magma | Marketplace for inbound liquidity | Liquidity | No | Open market and costs vary |

| Blocktank | Embeddable web widget for connecting channels | Combined | Yes | Costs vary based on channel order details |

| Boltz | Submarine swap service | Liquidity | Yes * | Costs vary based on network fees |

| Breez SDK | Mobile-client infrastructure and liquidity provider | Combined | Yes | Free |

| BTCPay Server | Server-side software for node and payment management | Infrastructure | Yes | Free |

| C= | Liquidity side connection to LDK Node implementations | Combined | Yes | Costs vary based on channel order details |

| LDK | Mobile-client side software for lightweight mobile nodes | Infrastructure | Yes | Free |

| Greenlight | Mobile-client infrastructure for lightweight mobile nodes | Infrastructure | Yes * | Free |

| Lightning Loop | Submarine swap service | Liquidity | Yes | Costs vary based on network fees |

| Lightning Pool | Marketplace for inbound liquidity | Liquidity | Yes | Costs vary based on network fees |

| Lightspark | Server-side platform for node and liquidity management | Combined | No * | 1,500 – $ 22,500 per month |

| Megalithic | Liquidity provider that allows for programmatic channel openings | Liquidity | No | Costs vary based on channel order details |

| Voltage | Server-side platform for node and liquidity management | Combined | No | $ 30 – $ 1,100 per month |

| Zeus Olympus | Liquidity provider that allows for programmatic channel openings | Liquidity | Yes | Costs vary based on channel order details |

Notes:

* Lightspark is currently working on a new solution called “Spark” which will debut in early 2025.

** Note that Boltz and Greenlight are now open source.

I think even from a short glance at the table, it’s clear that the range of services and costs for an LSP can vary greatly according to the specific needs of the business.

But to help clarify a bit, if running a profitable Lightning node isn’t a core part of your business plans, using one of the combination LSP listed above could be a huge benefit to your business! It’s also important to carefully select the exact amount of automation, liquidity and infrastructure for your project.

In conclusion, integrating Bitcoin Lightning Network payment solutions can offer significant benefits for businesses and developers, from faster and cheaper transactions to enabling micropayments and innovative new features. However, building and managing Lightning Network infrastructure from scratch can be a daunting task, requiring technical expertise and significant investments in liquidity.

Lightning Service Providers for Bitcoin offer a solution to these challenges by providing ready-built solutions for engineers and dev teams to integrate into their systems. Whether you require a user-friendly mobile wallet or a server-side node operator solution, there are LSPs that can help you meet your specific needs.

I recommend keeping an eye on this space as it’s developing quickly!

Hopefully you found this post useful and it has inspired you to build some cool Lighting Network functions into your mobile app, business software or website! It’s exciting to see all these new tools to make Bitcoin Lightning much more business and developer friendly.

If you’re inspired to build a Bitcoin Lightning enabled software, website or a mobile app, we’d love to hear about it. Contact us and let us know!

Resources and References:

https://river.com/learn/terms/r/replace-by-fee-rbf

https://medium.com/breez-technology/introducing-lightning-service-providers-fe9fb1665d5f

https://docs.lightning.engineering/the-lightning-network/liquidity/lightning-service-provider

https://blog.bitkit.to/the-rise-of-lightning-service-providers-6410274d5b70